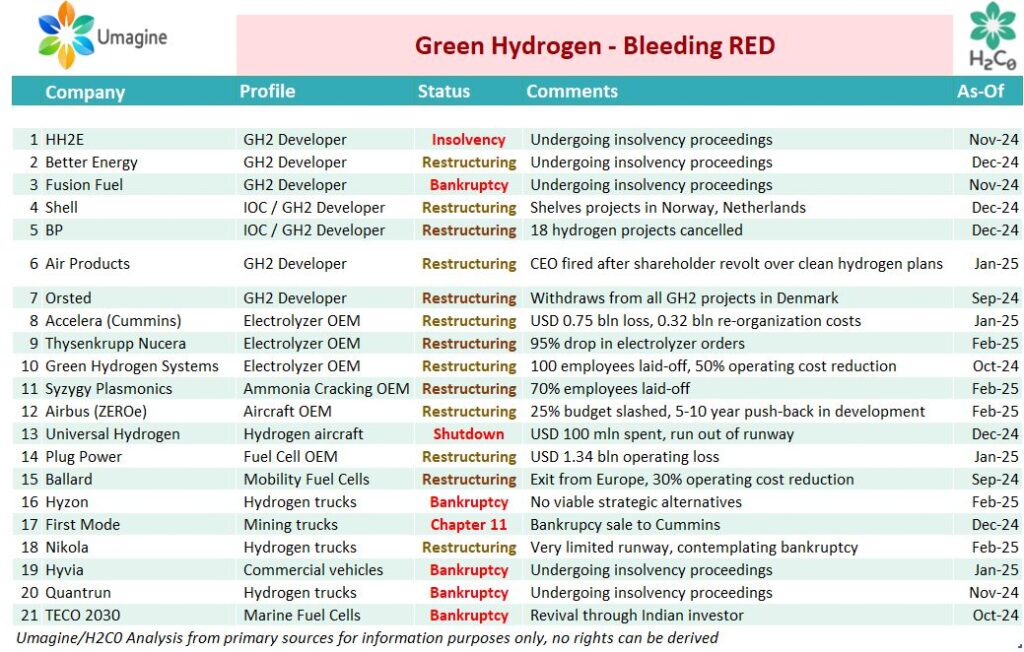

This is a follow up to a recent article, with the exhibit providing the list of bankruptcies, closures, restructuring, consolidations that the industry has been facing especially over the past few months.

The condition is nothing short of DIRE – with the hydrogen industry having been bought literally to its knees!

Some of the key reasons for this in my view are as follows:

Uncertain geopolitical scenario – with anti-climate governments across US and Europe, the momentum towards the hydrogen industry has resulted in significant headwinds

Bankability of projects or the lack of it – on one hand the natural gas prices are way lower than the 2021-22 period and on the other significant cost and schedule overruns, questionable technology maturity for large-scale electrolyzers, all resulting in very limited end-customers willing to sign-up for long term offtake agreements

Oil & Gas resurgence – with steady crude and gas prices, and a certain outlook with the “drill baby drill” rhetoric – most of the IOCs have dropped most of their hydrogen plans – sans 1-2 once-off projects to avoid write-offs.

This reverse gear-shift has had massive consequences as these IOCs were not too long back leading the hydrogen agenda.

Falling lithium battery prices – in addition to the lack of low cost hydrogen, very low battery prices are leading to slow-death and some final nail in the coffin for several heavy mobility applications of green hydrogen.

I have also compiled my view of some of the survival strategies for green hydrogen companies in this economy:

Focus on fundamentals – over-dependency on subsidies, mandates, or someone else paying for your green-premium is simply not going to happen – this means both focus on use-cases where the business case is realistic in the medium term, and not just rely on pilots.

Being lean and nimble – building fat organizations on basis of investor capital or cash-flow from other businesses is not going to be prudent – and this has been one of the major downfall reasons for most of these companies.

Focus on utilization – with significant overcapacity and very low utilization factors, there isn’t any point building another electrolyzer manufacturing factory. Rather, the use-cases with strong fundamentals should get priority.

Prudent financial strategy across debt and capex is important especially for those 100% dependent on the green hydrogen economy. Splurging is death-sentence in this industry.

With no other cash-rich businesses, we at Umagine / H2 Carbon Zero are in the same boat, and are diligently following the above. For our peers – STAY STRONG, let us weather through this together!

Source: Santosh K Garunath