Premium hydrogen market intelligence for industry professionals

Curated reports, white papers, studies, and presentations from leading hydrogen commentators, market analysts, research organisations, and industry experts.

Full access is available to premium subscribers.

Start with a FREE 30-day trial — cancel anytime.

Get instant access to our premium library of 500+ hydrogen market reports, white papers, and industry presentations, with new content added every week.

Subscribers use Global Hydrogen Hub to stay informed, compare market viewpoints, and save hours of research time — with trusted insights all in one place.

Already a subscriber ? Log in

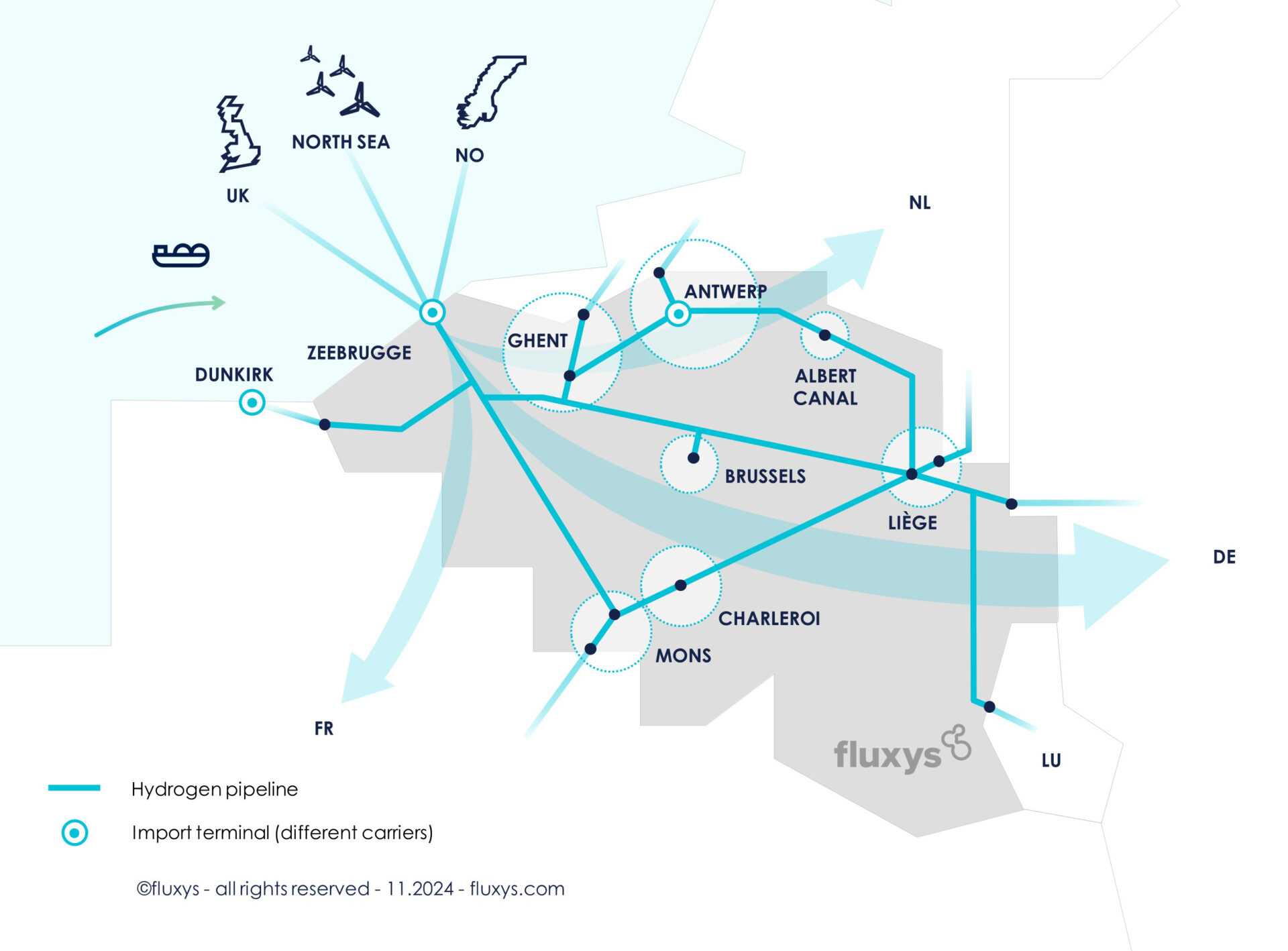

Belgium has published a study outlining the future framework for hydrogen terminals as part of the transposition of the EU Hydrogen and Decarbonised Gas Package. The document clarifies how hydrogen terminals handling liquid hydrogen or ammonia should be organised, operated and accessed under objective and non-discriminatory principles. A negotiated third-party access regime is proposed, with regulatory oversight primarily ex-post. The […]

FREE TRIAL

Already a subscriber ? Log in

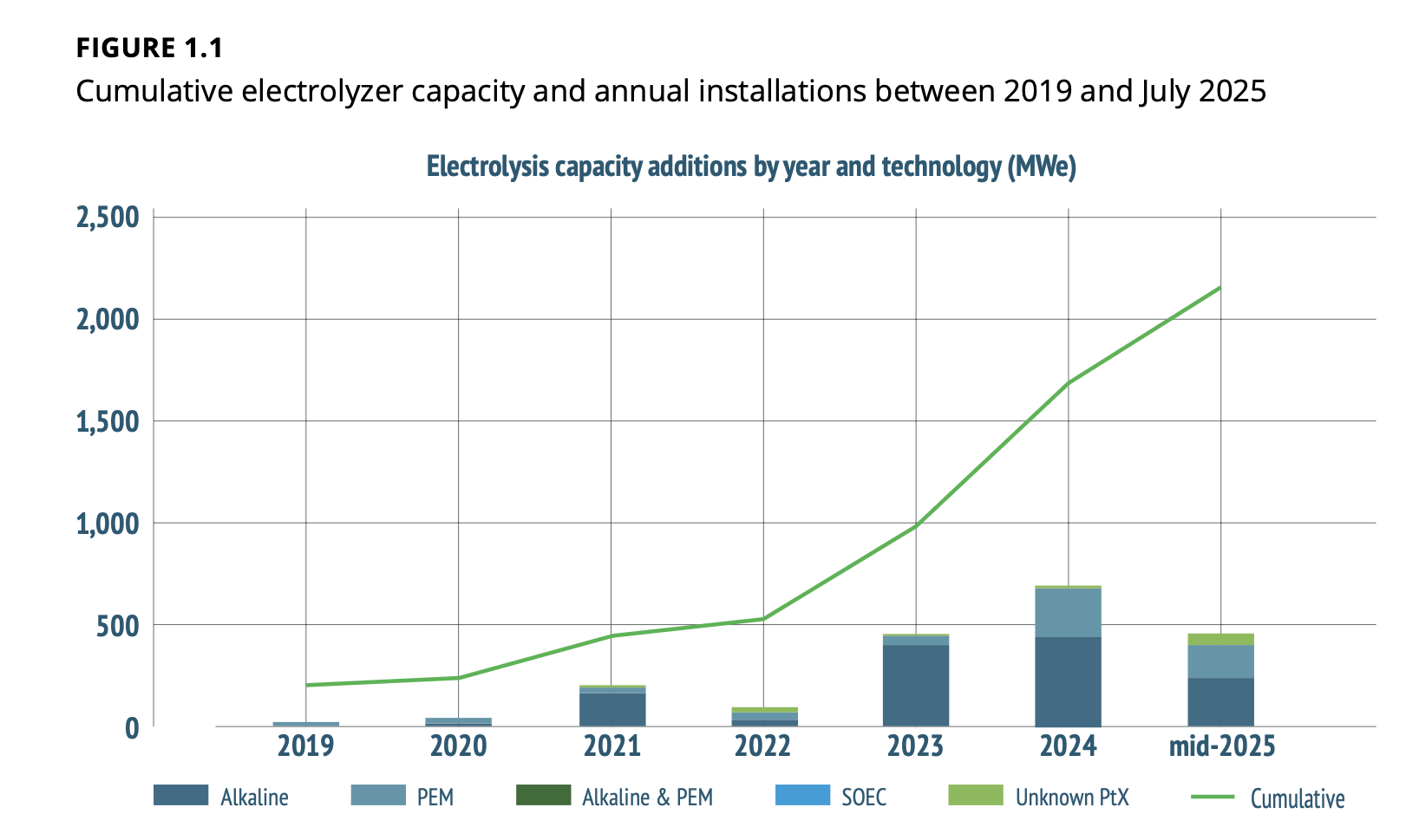

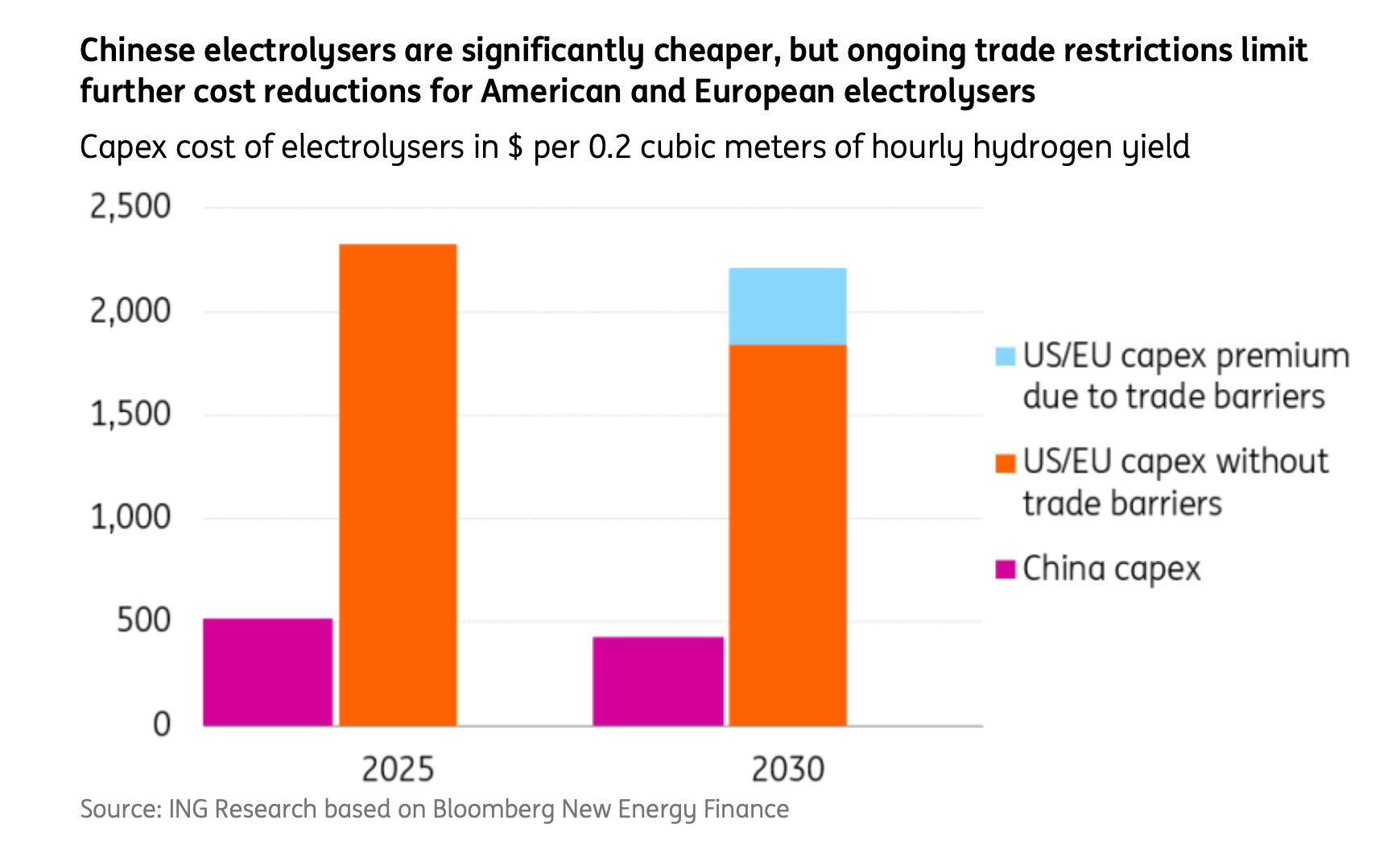

The electrolyzer market outlook shows rapid industrial expansion colliding with slower-than-expected demand growth. As of mid-2025, around 2.15 GW of electrolyzer capacity was operational globally, with nearly 20 GW including projects under construction or at FID. Yet global manufacturing capacity has surged to 61 GW per year, creating significant overcapacity and triggering sector consolidation. Alkaline (ALK) technology continues to dominate […]

FREE TRIAL

Already a subscriber ? Log in

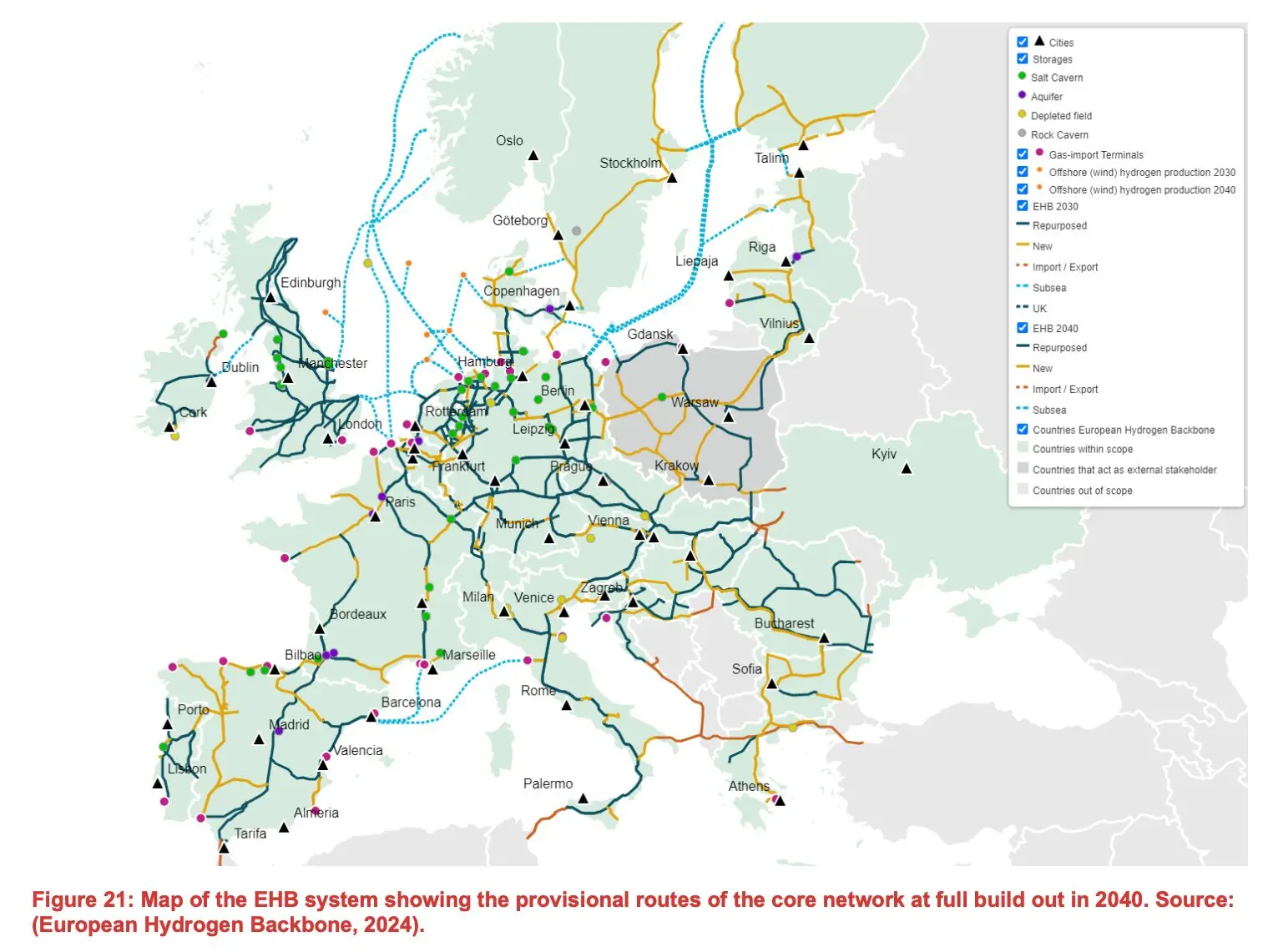

Ireland hydrogen exports are emerging as a central pillar of the country’s long-term energy transition strategy, with policymakers assessing how large-scale renewable resources could underpin future hydrogen production for export to Europe. The report outlines infrastructure requirements, potential export routes, and the role of offshore wind in supporting electrolysis at scale. Ireland hydrogen exports could become a strategic opportunity as […]

FREE TRIAL

Already a subscriber ? Log in

The hydrogen outlook 2026 signals a decisive year for project economics, policy credibility and global trade dynamics. After two years of optimism followed by reality checks, the market is entering a phase where only commercially robust projects are likely to move forward. Non-RFNBO hydrogen in Europe is expected to gain traction, ammonia cracking projects could reach final investment decision, and […]

FREE TRIAL

Already a subscriber ? Log in

Hydrogen’s advancement has stalled, with numerous project cancellations, high costs and sluggish demand. China may lead the way for global adoption in 2026, but scaling remains a complex, multi-stage process. Current efforts should focus on pilot projects reaching final investment decision (FID), which requires solid demand. The hydrogen analysis outlines a sector struggling to transition from policy ambition to commercial […]

FREE TRIAL

Already a subscriber ? Log in

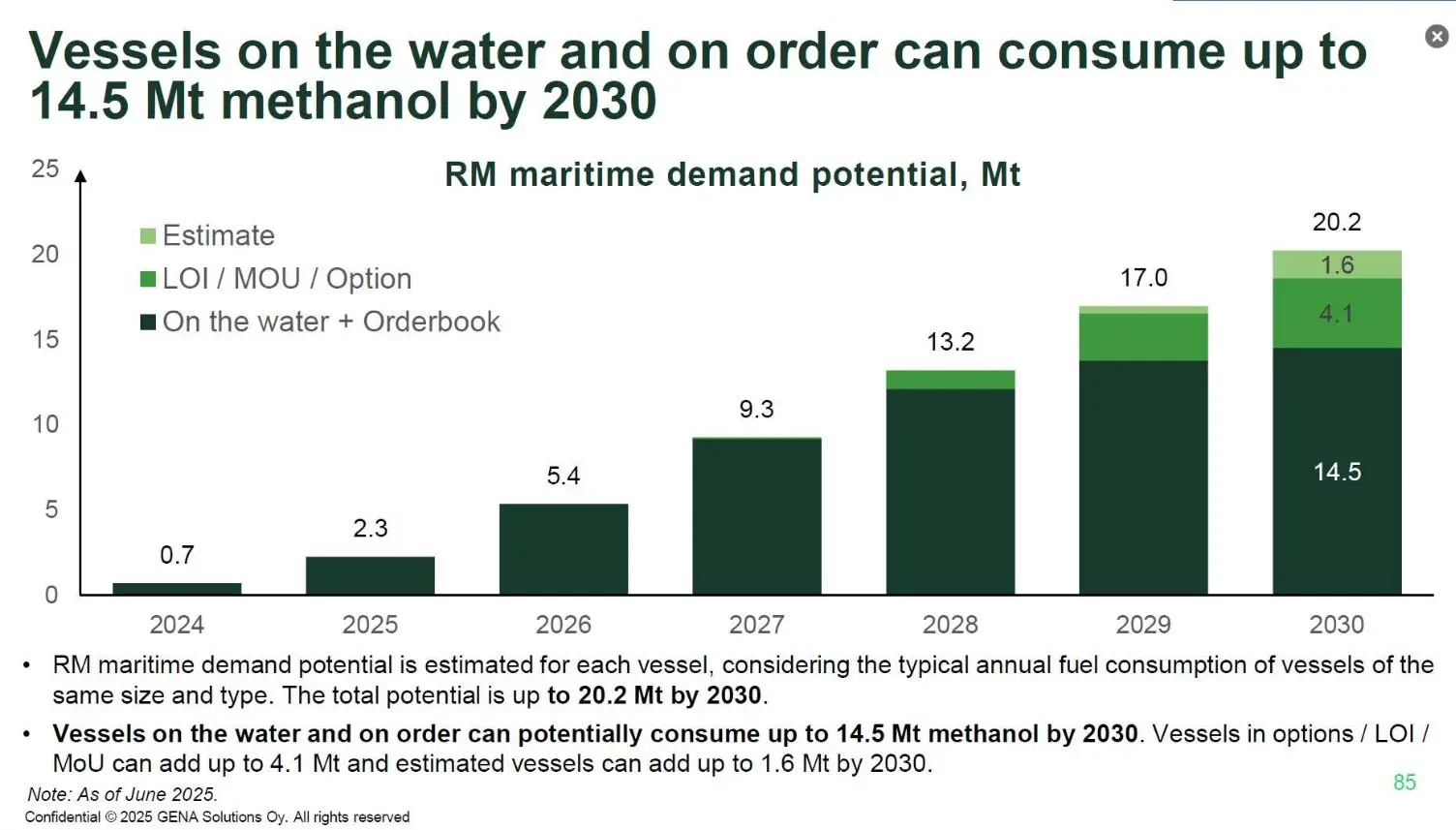

Methanol marine fuel adoption is accelerating as shipowners place large orders for dual-fuel vessels and engine manufacturers scale up production capacity. Maritime demand could reach significant volumes by 2030 as fleets transition toward low-carbon fuels supported by expanding renewable methanol supply and bunkering infrastructure. Methanol’s role as a hydrogen-derived fuel pathway is strengthening its position in shipping decarbonisation strategies. Shipping’s […]

FREE TRIAL

Already a subscriber ? Log in

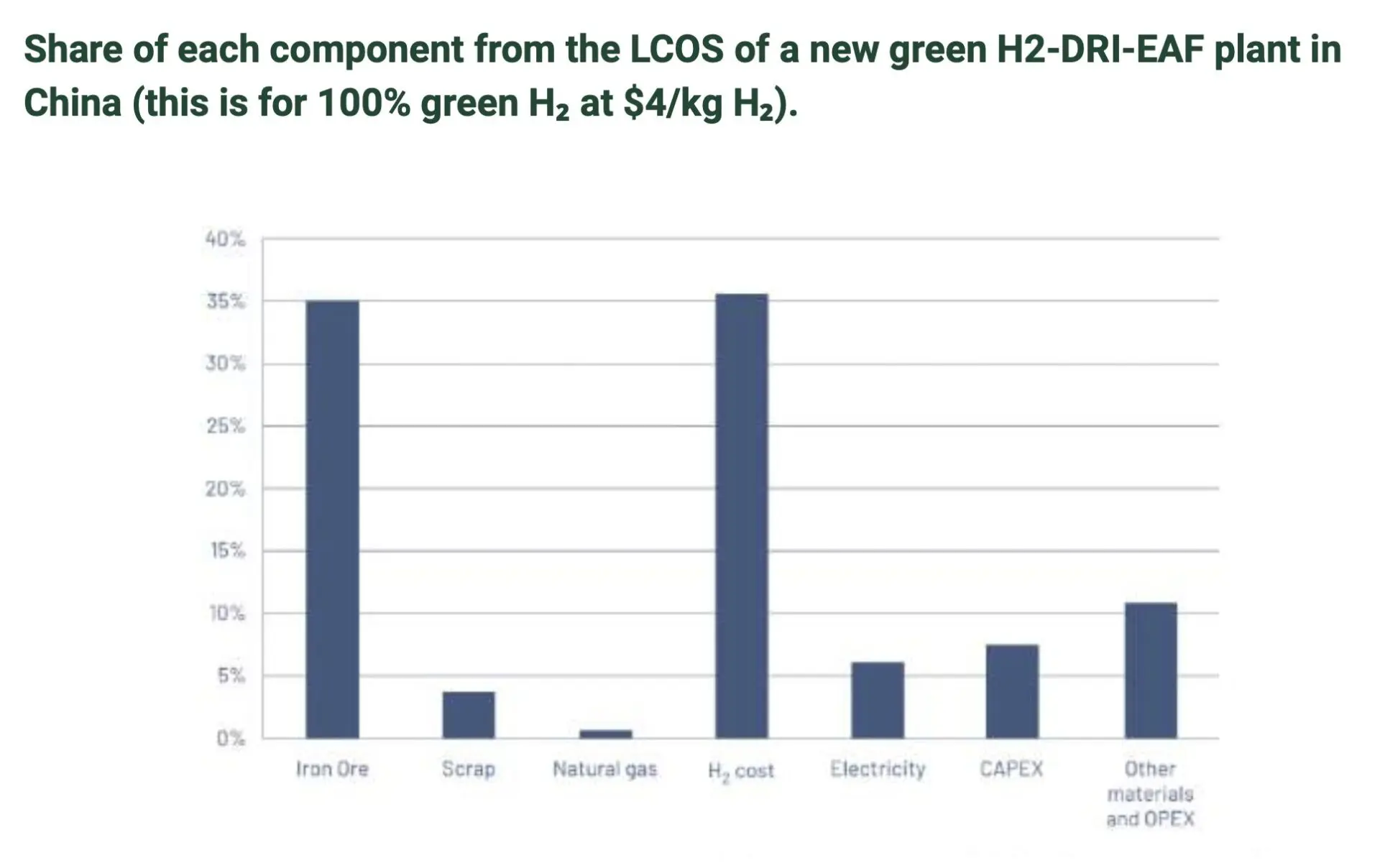

Green hydrogen is emerging as a critical pathway for steel decarbonisation, enabling near-zero-emissions iron production through hydrogen-based direct reduction processes. Countries in the MENA region are positioning themselves as future suppliers of low-carbon iron by leveraging abundant renewable resources and competitive hydrogen costs. Export demand from Europe and Asia is expected to accelerate deployment as carbon policies reshape global steel […]

FREE TRIAL

Already a subscriber ? Log in

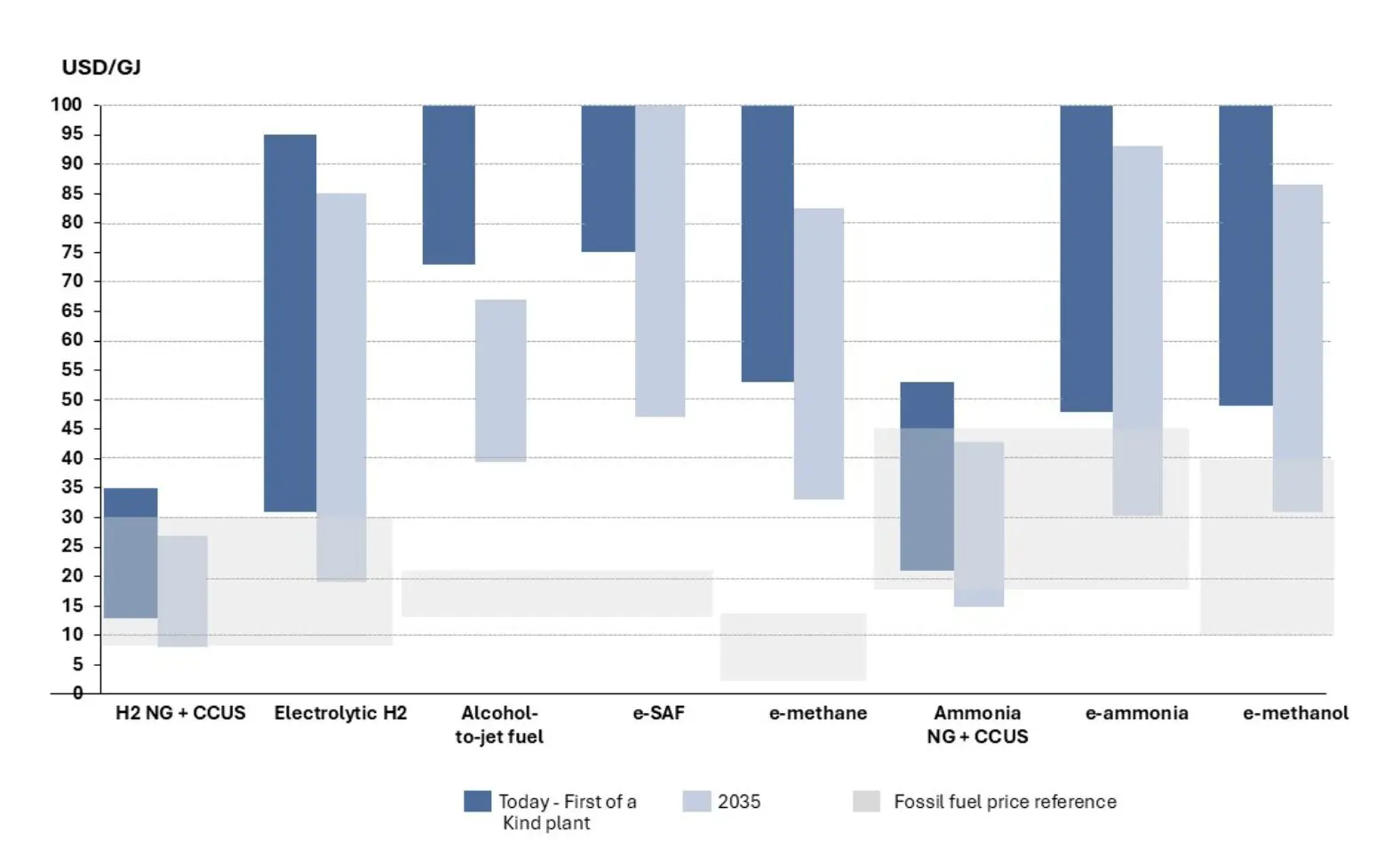

Low carbon fuels are becoming essential for decarbonizing aviation and maritime transport, sectors where electrification alone cannot meet long-distance energy requirements. Hydrogen plays a central role as the feedstock for synthetic fuels such as e-kerosene, e-methanol and e-ammonia, which can scale to support global transport demand. The paper highlights that policy support, infrastructure development and certification frameworks will determine how […]

FREE TRIAL

Already a subscriber ? Log in

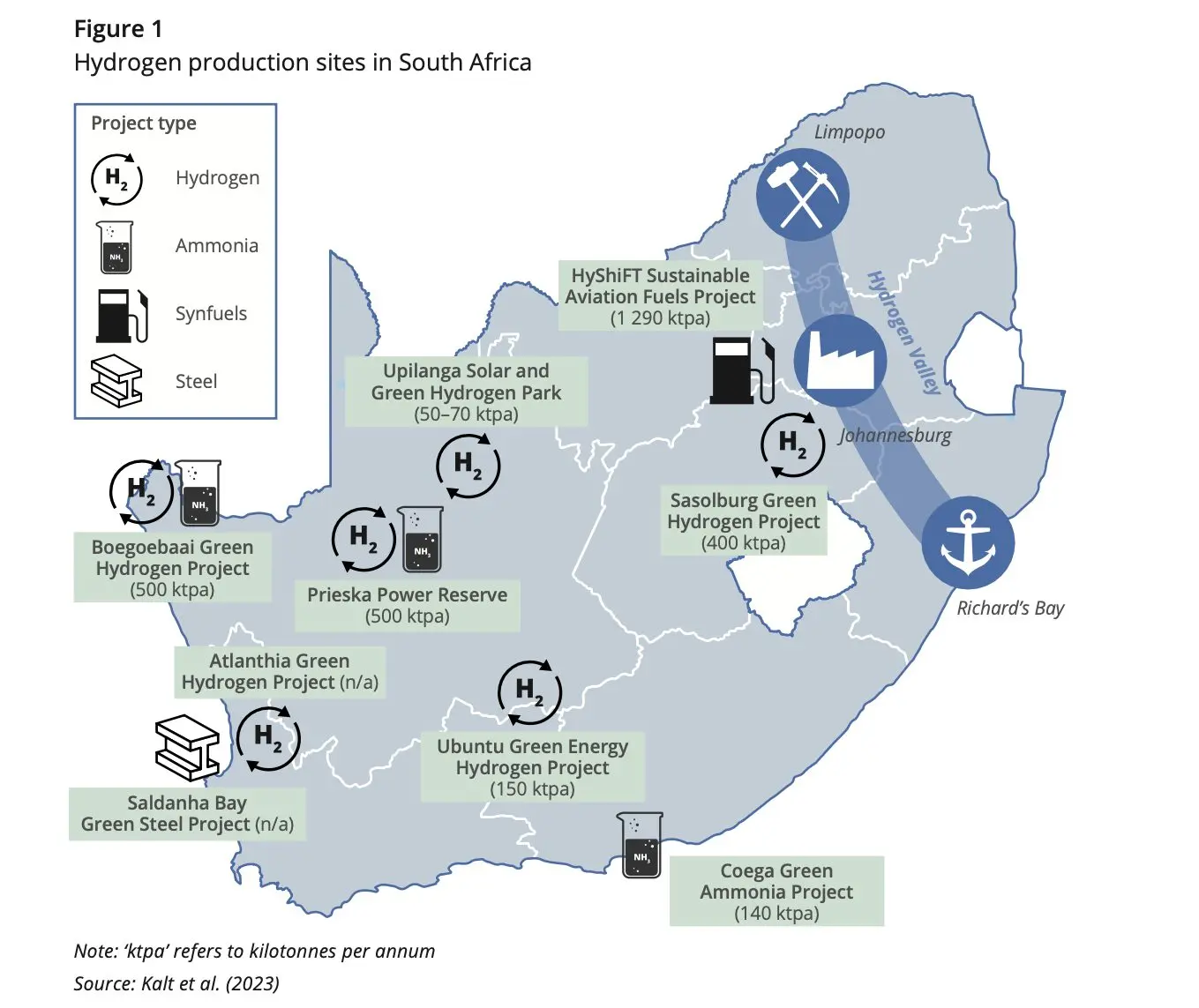

South Africa green hydrogen ambitions are built on the country’s dominant position in platinum group metals, which are essential for electrolysers and fuel cells. The report argues that this resource advantage could anchor a competitive hydrogen industry and position South Africa as a major exporter to Europe and Asia. However, significant structural barriers remain, including electricity shortages, infrastructure gaps, financing […]

FREE TRIAL

Already a subscriber ? Log in