Belgium sets framework for hydrogen terminals under EU hydrogen package

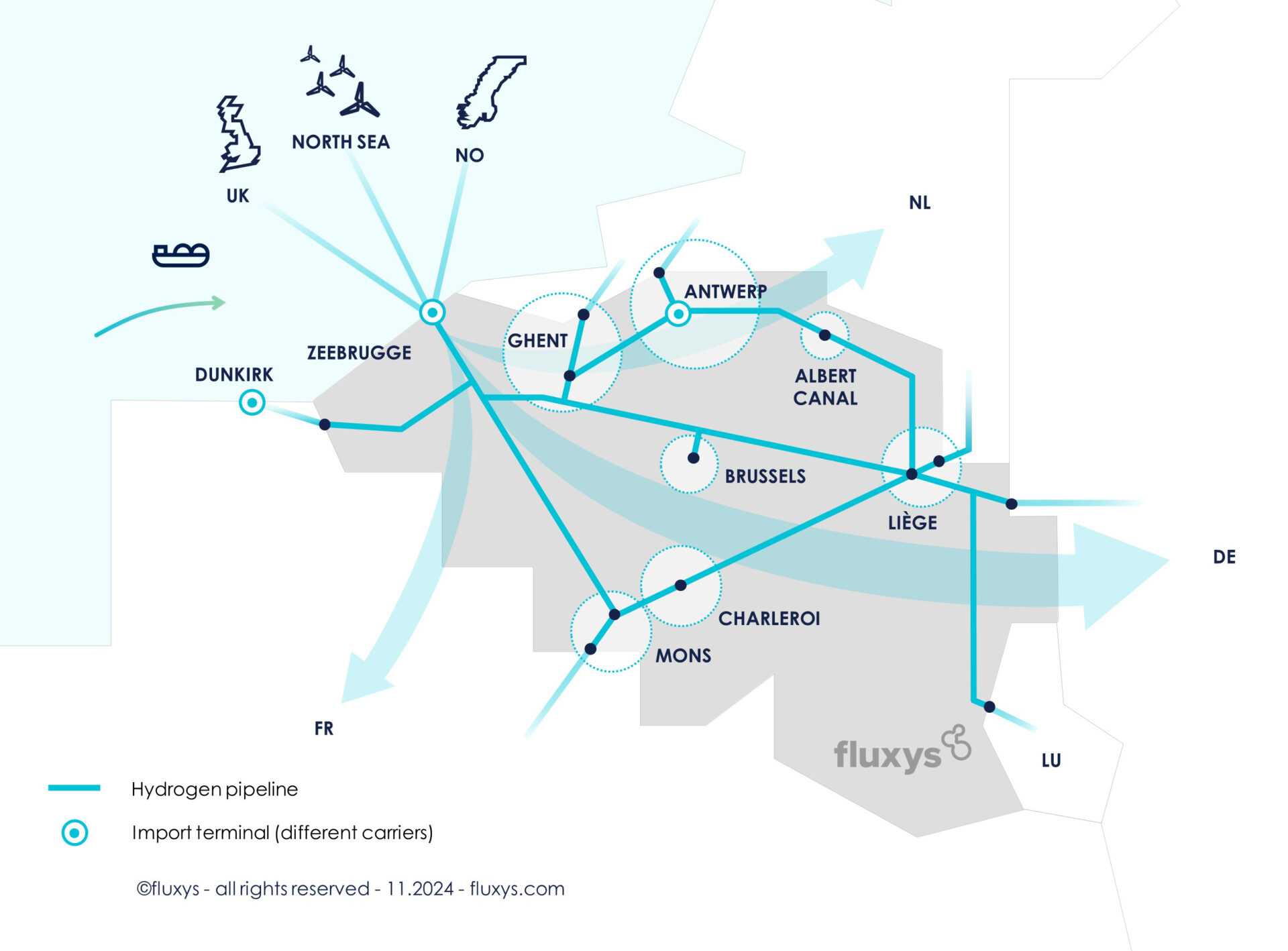

Belgium has published a study outlining the future framework for hydrogen terminals as part of the transposition of the EU Hydrogen and Decarbonised Gas Package. The document clarifies how hydrogen terminals handling liquid hydrogen or ammonia should be organised, operated and accessed under objective and non-discriminatory principles. A negotiated third-party access regime is proposed, with regulatory oversight primarily ex-post. The […]