CEDIGAZ has recently published its annual survey on the global hydrogen market along with comprehensive databases on low-emission hydrogen production projects worldwide.

The report tracks recent policy and market developments of the global low-emission hydrogen sector. It also focuses on project development and medium-term supply prospects.

The hydrogen industry is at a pivotal stage, with significant progress made in investments, policy support, and project development. However, the market remains in its infancy, with substantial challenges in cost, infrastructure, and demand uptake.

The next five years will be critical for scaling hydrogen production and establishing a global market. Stronger policies, international collaboration, and technological advancements are essential to unlock hydrogen’s full potential as a cornerstone of the energy transition.

According to Cedigaz, low-emission hydrogen represented only less than 2% of the global hydrogen demand in 2024. The low-emission hydrogen market is just beginning to take shape and is focused on decarbonizing current industrial uses of hydrogen.

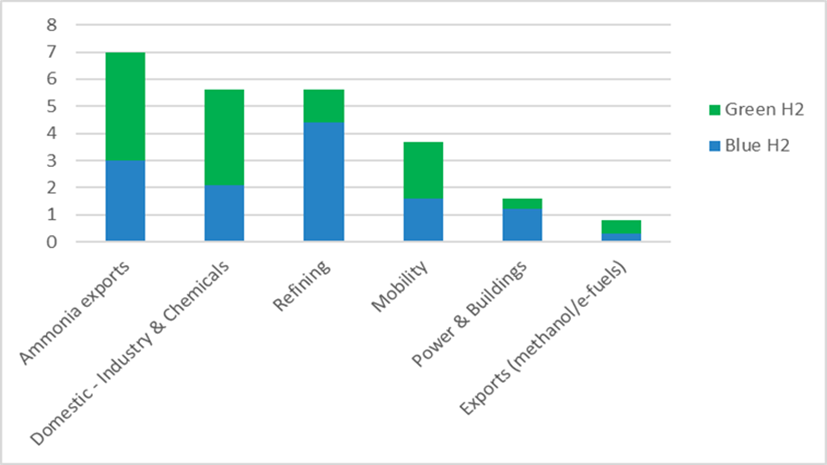

Demand for low-emission hydrogen mainly concerns the refining and chemical sectors and is insignificant in other sectors that are difficult to decarbonize. Most installations are blue hydrogen production units in the refining and fertilizer production sectors in North America. On the other hand, growth in green hydrogen production has been very slow to date.

It’s only since 2022 that important decisions have been taken to finance green hydrogen. At the end of 2024, worldwide electrolysis capacity was estimated at 1.4 GW, compared with 30 MW in 2021.

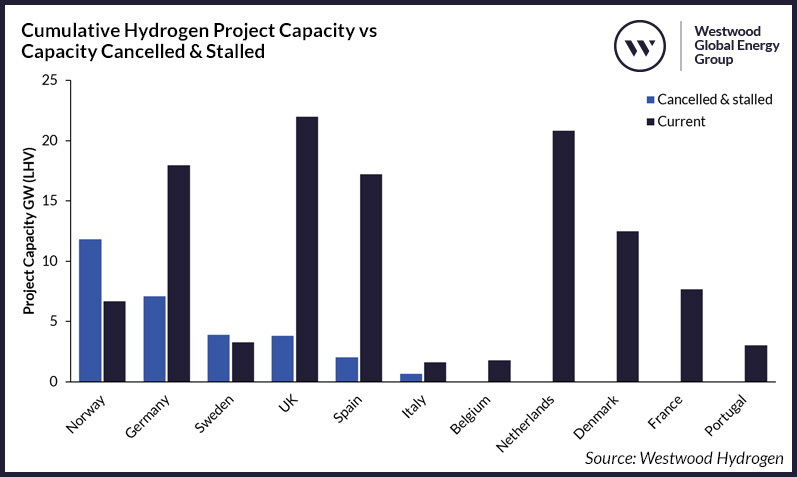

Investment in hydrogen is accelerating thanks to policy support and industrial strategies. According to Cedigaz, projects at a relatively advanced stage that could come on stream by 2030 account for a production potential of 38 Mt at the end-2030 in a best-case scenario.

Although the number of FIDs has increased since the beginning of the decade, post-FID projects added to existing production (and considered to be under construction) accounted for only 4.3 Mt by the end of 2024 (including 2.4 Mt of blue hydrogen and 1.9 Mt of green hydrogen), or 11% of the total planned capacity.

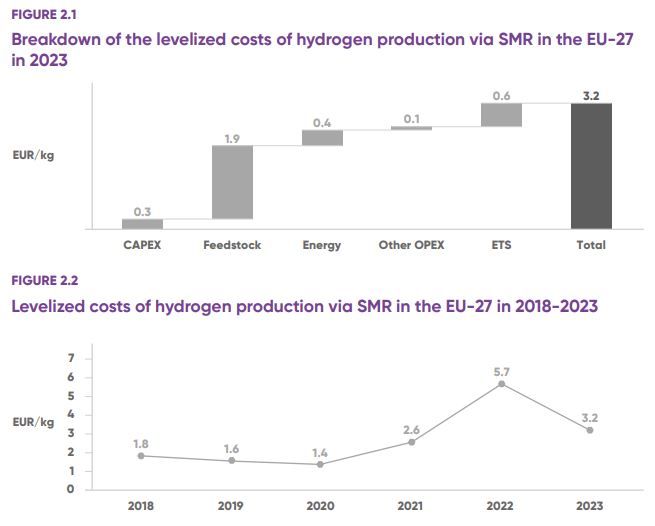

Given the price differential to green hydrogen, blue hydrogen is expected to dominate the global low-emission hydrogen market for the next three years. As a result, investments will likely concentrate in areas holding cheap natural gas resources like the US and Canada.

Most Reference Scenarios from agencies and consultants forecast that global low-emission hydrogen supply will rise to between 15 Mt and 20 Mt in 2030. Global hydrogen uptake is very low and late relative to Paris Agreement.

According to Cedigaz Base-Case Scenario, demand and production of low-emission hydrogen will reach just over 20 Mt in 2030, representing an additional volume of 8 Mt for blue hydrogen and 12 Mt for green hydrogen.

Potential projects’ capacity will be sufficient to meet these needs. However, this projection is optimistic given the current situation, as achieving this growth will require a strong acceleration in project developments.

Alongside R&D, public funding and technological developments needed to bring down the costs and remove technological barriers, companies need to pursue collaboration efforts with all players involved, develop appropriate business models and solid international partnerships to allow the build-up of integrated international supply projects.

Source: Cedigaz