2025 is well underway for hydrogen with Korea allocating substantial subsidies for H2 vehicles, Chinese electrolyser manufacturers winning selection for a green ammonia project in Oman, Singapore picking a supplier for hydrogen-ready (to 30%) CCGT and German utility Uniper agreeing a fixed-price structure for 42,000 tpy of Norwegian green hydrogen exports.

Meanwhile, the US has tweaked production tax credit rules on the eve of the new administration, relaxing rules on additionality and pushing back hourly matching align with the EU’s start date.

Part of that update also affects ‘blue’ products: allowing project-specific emissions data to be submitted more fully opens the door to 45V credits for ultra-low carbon projects, fed by natural gas with low fugitive emissions rates.

Using fixed 45VH2GREET assumptions for upstream emissions outside of the facility, US Blue Ammonia producers had a well-to-gate intensity of 0.476t CO2e per tonne of blue ammonia produced, whereas scope 1 emissions were far lower at 0.118t.

That data is important to NE Asian importers weighing carbon intensity as a metric for choosing suppliers: they could see a lower well-to-gate number from projects that can demonstrate low natural gas leakage rates.

The prime factor remains price and the Japan Korea Low-carbon Ammonia Benchmark (JKLAB) ended the year falling to US$707.34/t (excluding 45Q subsidies).

For its part, the EU will be very keen to turn the page on a lackluster ’24. Fundamentally the bloc has to choose whether to maintain or loosen 2030 mandates for renewable hydrogen use; potentially a live case-study in realpolitik.

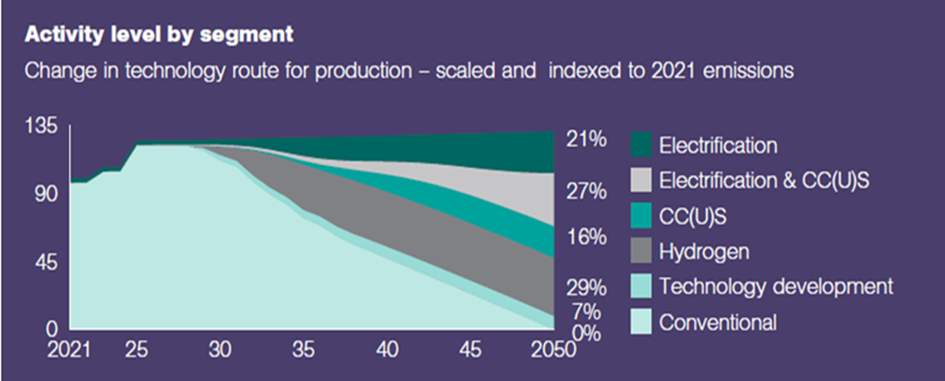

Source: Tim Hard, ICIS

Additional information: join the ICIS Hydrogen team in a webinar on January 15 where they provide their outlook for hydrogen in 2025