Southeast Asian low-emissions hydrogen production could reach 480,000 t/yr by 2030 based on announced projects but progress has been slow, Paris-based energy watchdog the IEA says.

Developers have announced 25 projects that are slated to start operations by 2030, with all of them targeting electrolysis and 40pc aiming for exports, the IEA says in a southeast Asia focus section of its Global Hydrogen Review 2025. More than 90pc of the 480,000 t/yr combined capacity is in Malaysia and Indonesia and two projects account for nearly half of the total, the watchdog says.

These are a 1GW nuclear-powered ammonia project in Indonesia targeting 180,000 t/yr of hydrogen by 2028, and a hydropower-based project in Malaysia aiming for 150,000 t/yr by 2028. But the timelines appear increasingly ambitious in both cases and the only major project to have reached a final investment decision is in Vietnam, with the Tra Vinh plant aiming for 24,000 t/yr of renewable hydrogen to make 182,000 t/yr of ammonia under construction.

While some large projects have been announced, the regional pipeline lacks mature 50-250MW projects to bridge the gap to GW-scale projects, the IEA says.

Another 22 projects have been announced with a start date beyond 2030, lifting total announced capacity to 5.7mn t/yr. But 5.2mn t/yr of this is at the concept stage and “highly speculative,” the IEA says.

Southeast Asia has ample potential for renewable hydrogen production — the IEA estimates the region could theoretically produce as much as 11mn t/yr at a cost of less than $6/kg by 2030. Indonesia has the largest potential, drawing on its abundant solar irradiation and accounting for 90pc of the region’s output that could be produced at less than $5.50/kg by 2030, based on IEA modelling.

While the renewables potential is strong, financing costs are a major barrier as the cost of capital adds 45-55pc to levelised hydrogen production costs compared with more advanced economies, the IEA said. Unlike larger economies, governments in the region have not offered major subsidies to help projects along.

Hydrogen made from natural gas with carbon capture and storage or utilisation would be cheaper than renewable production, but risks increasing gas import dependence as Asean is transitioning from being a net exporter to a net importer, the watchdog says.

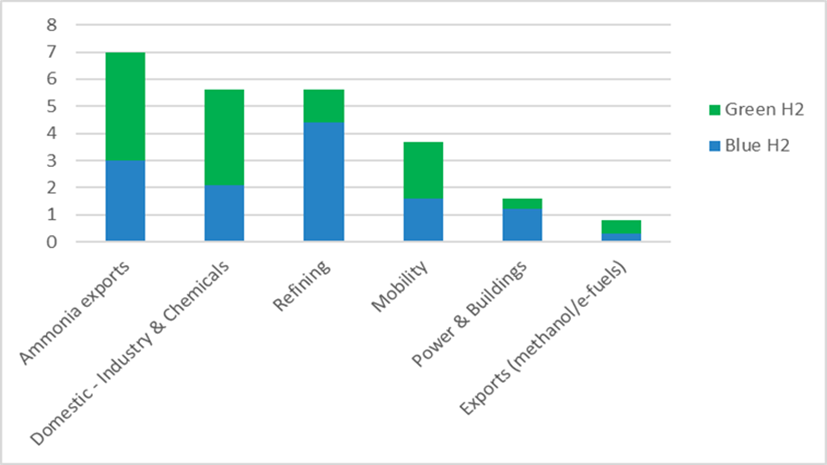

The IEA notes that state-owned firms could “spur growth of low-emissions hydrogen,” including for use in existing hydrogen applications such as fertiliser production and refining. Southeast Asian countries consumed 4mn t of hydrogen in 2024. Nearly half of this was for ammonia, especially in Indonesia, and one-third for refineries, mostly concentrated in Singapore.

Methanol and ammonia bunkering, especially in Singapore, could be among the new use cases for low-emissions hydrogen going forward. Singapore has advanced tenders for ammonia-to-power pilots and ammonia bunkering, and is also planning to introduce hydrogen use in the power sector.

Source: Chingis Idrissov (Argus Media)