Europe’s hydrogen market saw renewed policy activity in November, signalling a shift toward strengthening long-term offtake structures and improving revenue visibility for European hydrogen projects. While new EU and UK measures aim to accelerate market development, progress remains uneven, with project advances occurring alongside notable cancellations.

Policy focus shifts toward offtake certainty

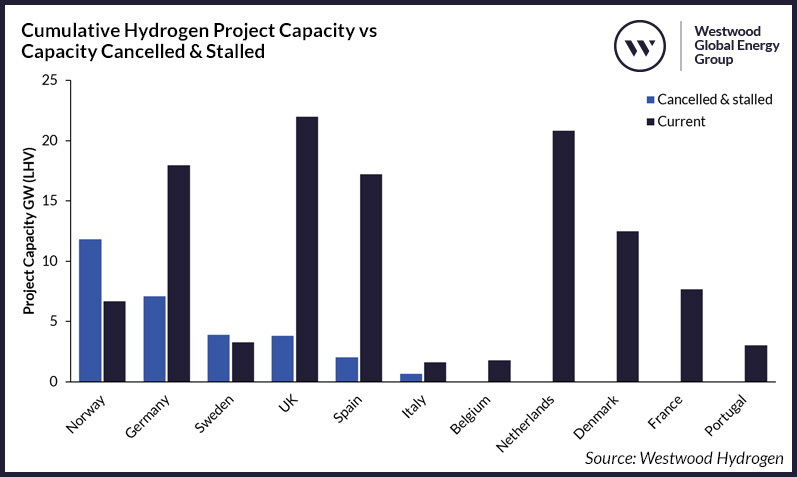

Only around a quarter of announced European hydrogen projects currently have a confirmed offtake agreement or MoU in place, leaving financing difficult and timelines uncertain. November brought tangible steps to address this.

The European Commission launched the first call for supply offers under the Hydrogen Mechanism, a matchmaking platform created under the European Hydrogen Bank.

Running through 2029, the platform aims to link renewable and low-carbon hydrogen producers with credible EU-based offtakers and provide access to financial instruments that help early agreements become bankable.

The initial call closes on 2 January 2026, with anonymised summaries expected on 19 January.

Current data from Westwood shows that electrolytic hydrogen accounts for 72% of existing offtake agreements, with CCS-enabled production making up the remainder. Nearly half of all agreements are co-located supply–demand arrangements on the same industrial site, while a further 40% are concentrated in ports and industrial hubs. Chemicals, steel and refining dominate early adoption, representing more than two-thirds of offtake commitments.

Regulatory clarity expands production pathways

November also saw progress on the regulatory front. The EU’s Delegated Act on low-carbon hydrogen entered into law, providing long-awaited clarity for CCS-enabled hydrogen and for electrolysis powered by grid or nuclear electricity outside the RFNBO definition. The Act extends low-carbon classification to ammonia, methanol, e-fuels and other syngas-derived products, and will take effect on 11 December 2025.

In the UK, the Autumn Budget confirmed that electricity used for electrolytic hydrogen production will be exempt from the Climate Change Levy from spring 2026, removing a cost disadvantage relative to CCS-enabled pathways.

Mixed project signals across Europe

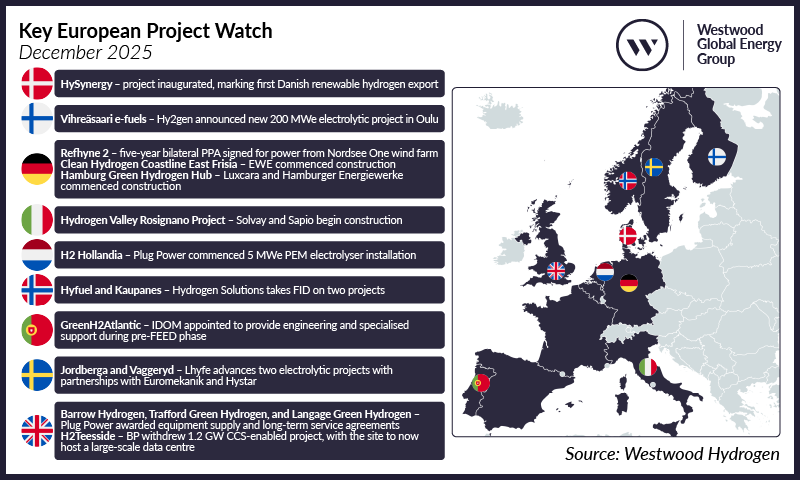

November delivered further progress on individual projects, including new commencements, FIDs, electrolyser deliveries and fresh partnerships. However, this positive activity was offset by BP’s withdrawal of its 1.2GW H2Teesside project, which was cancelled because the site is being prioritised for a proposed hyperscale data centre.

The announcement underscores the rising competition facing hydrogen developers as land and grid constraints tighten — particularly near ports and industrial clusters.

Source: Westwood Hydrogen Compass – December 2025