Blue or green hydrogen, pipelines or shipping? Maybe these questions are the most popular in the hydrogen sector. BP provided the analysis of these issues in its Energy Outlook 2023.

Main takeaways:

Currently the production of blue hydrogen costs lower than green hydrogen. However, the policy initiatives (the IRA in the USA) and higher natural gas prices in Europe and Asia has reduced this cost advantage in some countries and regions.

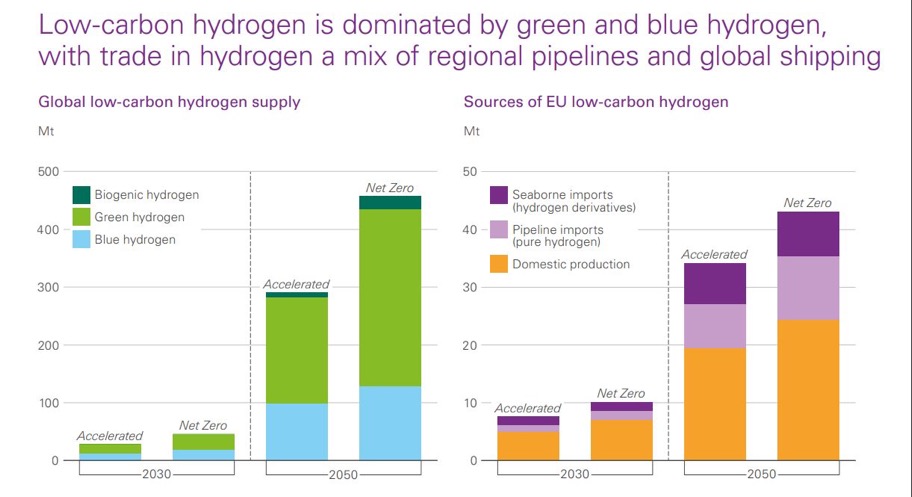

Green hydrogen accounts for around 60% of hydrogen in 2030, with that share increasing to around 65% by 2050. Most of the remaining hydrogen is provided by blue hydrogen, with a small amount produced from bioenergy combined with carbon capture and storage.

The form of hydrogen for trade can likely depend on off-takers. For off-takers that require hydrogen in its pure form, hydrogen is likely to be imported via pipelines from regional markets.

In contrast, for activities that can use hydrogen derivatives, such as ammonia and methanol in marine and the lower cost of shipping these derivatives allows imports from the most cost-advantaged locations globally.

However, the report does not mention other hydrogen carriers such as LOHC that provide a solution for hydrogen transportation by shipping and release of hydrogen in pure form to off-takers.