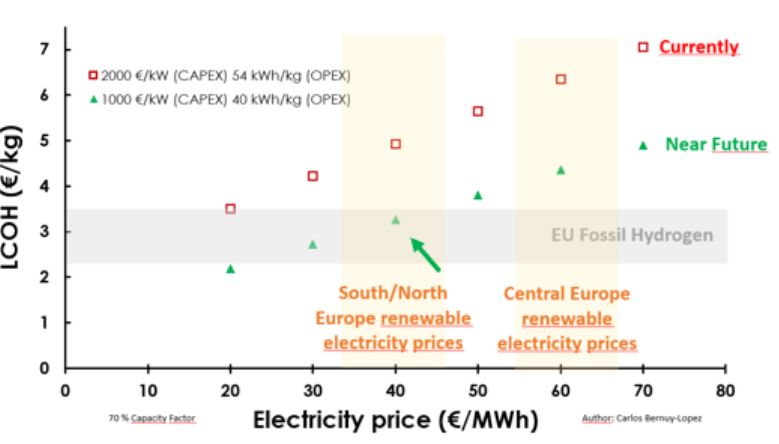

Luxembourg-based steelmaker ArcelorMittal said it will not proceed with previously announced direct-reduced iron (DRI) and electric arc furnace (EAF) decarbonisation projects at Bremen and Eisenhuttenstadt in Germany. The company cited unfavourable policy and slower than expected progress in the energy transition — particularly the lack of commercially viable renewable hydrogen.

The company initially planned to supply DRI from Bremen to the EAF in Eisenhuttenstadt after their construction.

ArcelorMittal first announced the plans in 2021, projecting that the two sites could produce up to 3.5mn t/yr of steel using renewable hydrogen by 2030. The company initially planned to use natural gas for DRI production in Bremen and gradually switch to renewable hydrogen.

But in November last year, the company said it was unable to take final investment decisions on building the DRI-EAF assets in the EU because of challenging energy, policy and market environments that were not moving in a favourable direction.

The projects were slated to receive €1.3bn ($1.5bn) in subsidies from the German federal government, contingent on construction beginning by June 2025. Even with that support, the business case remains too weak, ArcelorMittal Europe chief executive Geert van Poelvoorde said. The company has formally notified the government it will not be taking the subsidies. “This decision underlines the scale of the challenge. As it stands, the European steel industry is under unprecedented pressure to stay viable — without factoring in the additional costs required to decarbonise,” Poelvoorde said.

It remains unclear what the company’s decision means for its related partnerships with German utility RWE and US-based Plug Power. ArcelorMittal and RWE announced plans in 2022 to identify locations for electrolysis plants to supply renewable hydrogen to the steelmaker’s Bremen and Eisenhuttenstadt sites, starting with a 70MW pilot facility by 2026. In a separate agreement in 2023, Plug Power committed to supply two 5MW electrolysers to utility SWB for ArcelorMittal’s green steel feasibility project at Bremen.

The company has urged the EU to accelerate enforcement of the carbon border adjustment mechanism, strengthen trade protections and implement the EU Metals Action Plan to restore the competitiveness of low-emissions steel.

In May, ArcelorMittal confirmed its intention to invest €1.2bn in a new EAF at its Dunkirk site in France. Market participants suggest the company was delaying its DRI investments in Ghent, Belgium, and Dunkirk, but the steelmaker has yet to comment. The French government in 2023 approved an €850mn grant to ArcelorMittal to decarbonise its Dunkirk asset.

ArcelorMittal’s move comes as other steelmakers in Germany also reassess their decarbonisation timelines. Thyssenkrupp, for instance, has warned that its planned DRI plant in Duisburg — expected to switch from natural gas to hydrogen — may not be economically viable under current conditions.

Source: Argus Media