According to Westwood’s Hydrogen Compass (January 2026), the European hydrogen market is shifting from rapid ambition to more disciplined delivery.

After several years of bold targets and project announcements, developers are now focusing on bankability, offtake security and regulatory clarity. Progress continues, but growth is increasingly selective. Westwood notes that offtake uncertainty remains a central constraint.

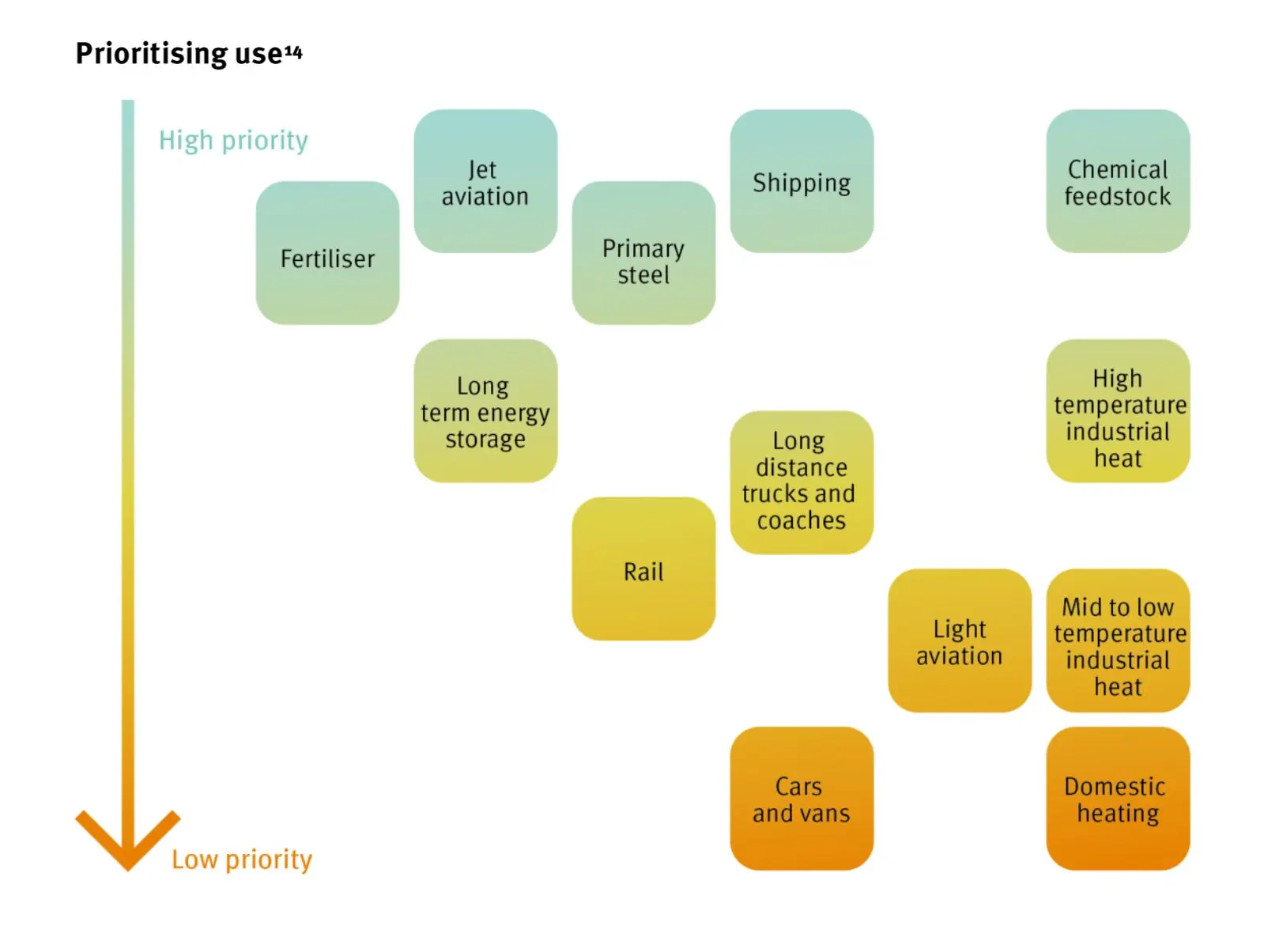

While supply ambitions are strong, firm demand is still limited beyond a small group of industrial users. Many projects depend on long-term offtake agreements and public support to reach financial close.

Regulation is another moving piece. Implementation of RED III varies across Europe, while RFNBO rules and low-carbon hydrogen definitions are still evolving. This adds uncertainty for developers and investors in the European hydrogen market.

2026 as a policy and funding year

Westwood sees 2026 as an important year for policy and funding signals. In the UK and EU, hydrogen support schemes and auctions are designed to reduce risk and stimulate demand. Their real impact will depend on execution and investor confidence.

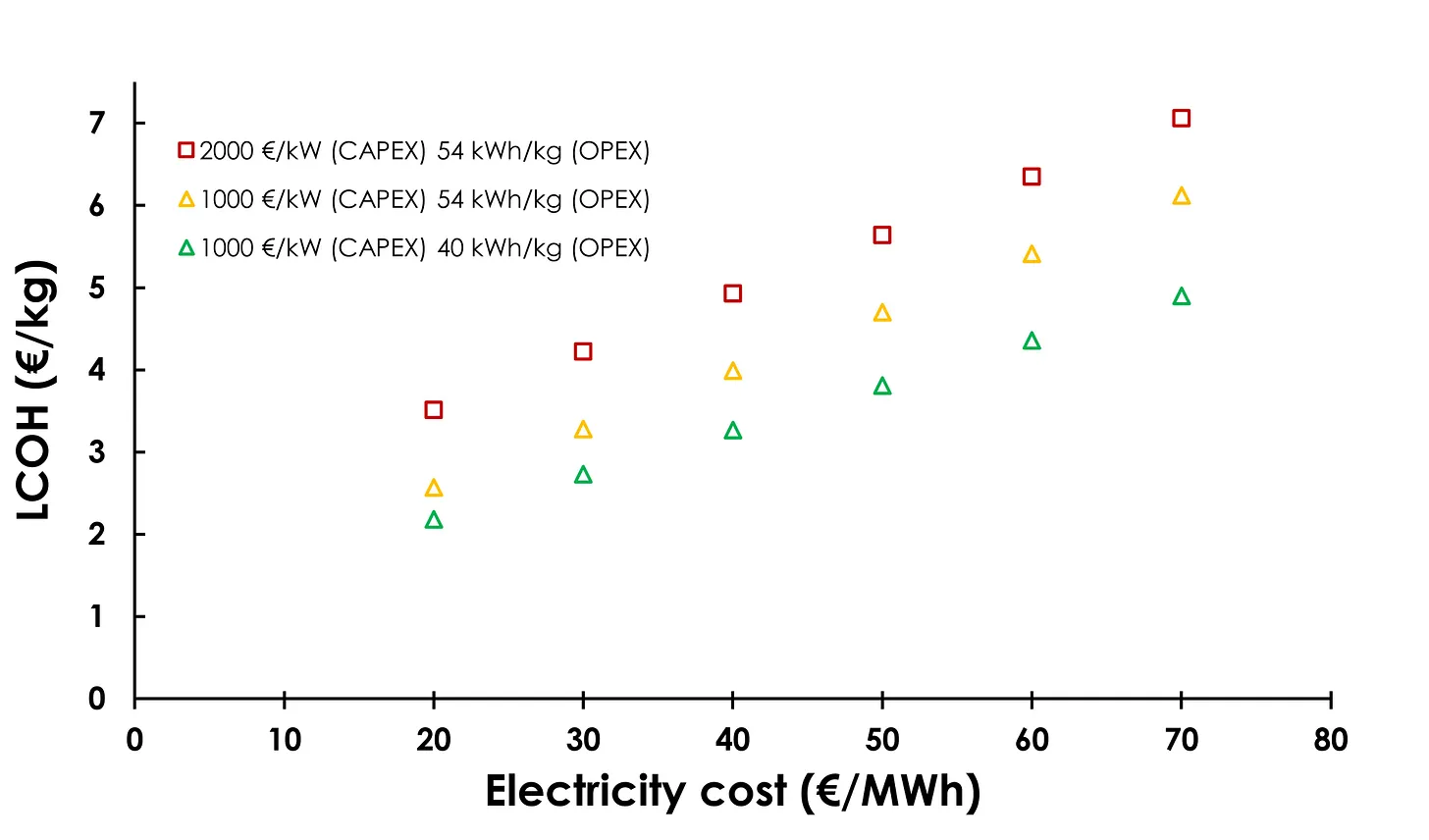

Electrolytic capacity is expected to rise, potentially pushing Europe beyond the gigawatt scale. However, most growth is concentrated in a small number of large, government-backed projects. Public funding remains a key driver.

From hype to measured growth

Westwood’s conclusion is that the European hydrogen market is maturing rather than slowing. The shift toward more realistic, demand-linked projects may ultimately strengthen the sector. For industry participants, 2026 will be a year where policy clarity, funding access and credible business cases matter more than headline targets.