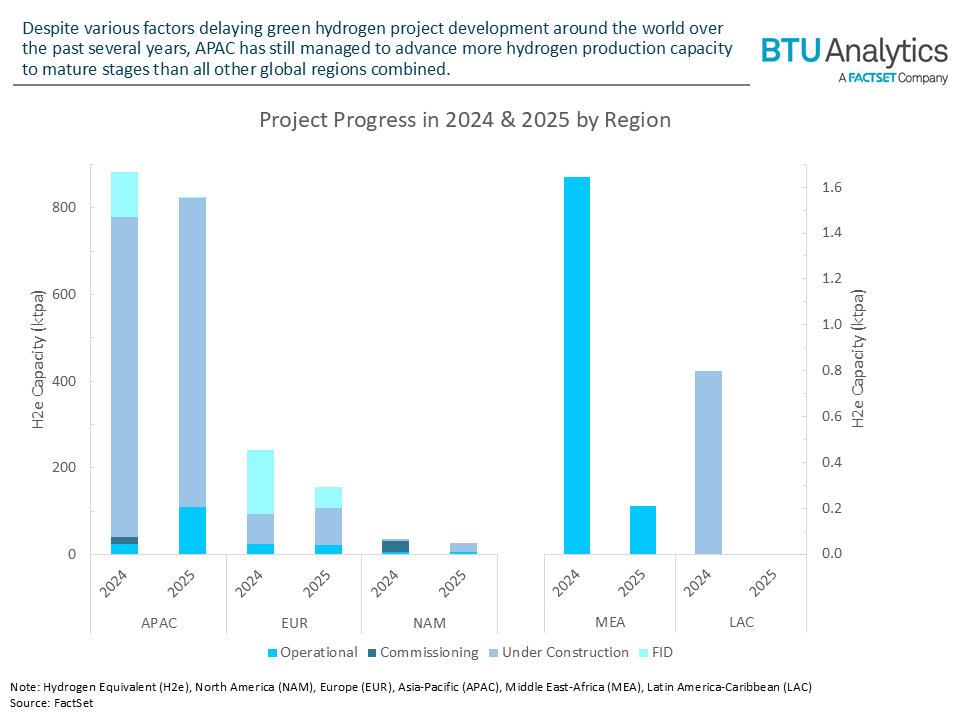

New data and studies highlight accelerating global hydrogen infrastructure — from trade corridors and backbone projects to regulatory harmonisation and shifting gas market dynamics.

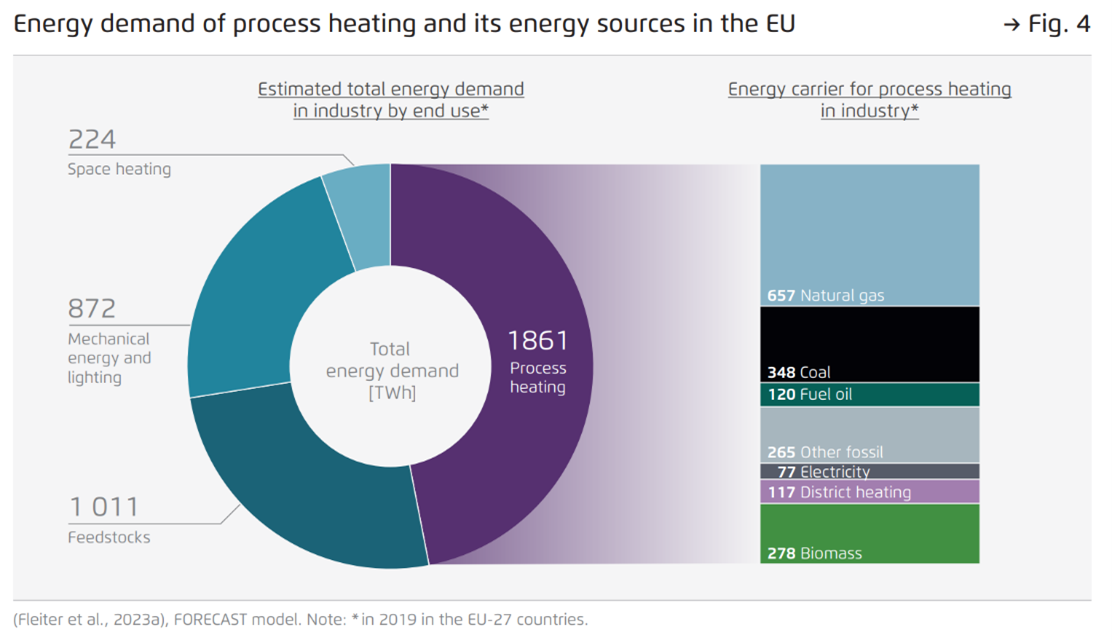

The global hydrogen infrastructure landscape is rapidly evolving as lower gas prices, network investments, and new policy frameworks converge to shape the next growth phase.

In energy markets, softening LNG prices through 2030 could have a mixed impact — challenging green hydrogen competitiveness while boosting blue hydrogen economics.

Yet investment momentum is holding as developers and policymakers look to balance affordability with decarbonisation goals.

On the infrastructure front, Denmark’s first hydrogen transmission line — linking Esbjerg to Germany — marks a key step in building Europe’s cross-border hydrogen network, while feasibility work on a South Africa–Europe green ammonia corridor underscores the growing role of long-distance hydrogen trade.

At the same time, regional assessments show uneven hydrogen readiness across Europe, with clear gaps in regulation, training, and funding.

Together, these developments point to a market entering a more mature, interconnected phase — where gas, hydrogen, and ammonia value chains are increasingly linked through shared regulation, system planning, and trade flows.