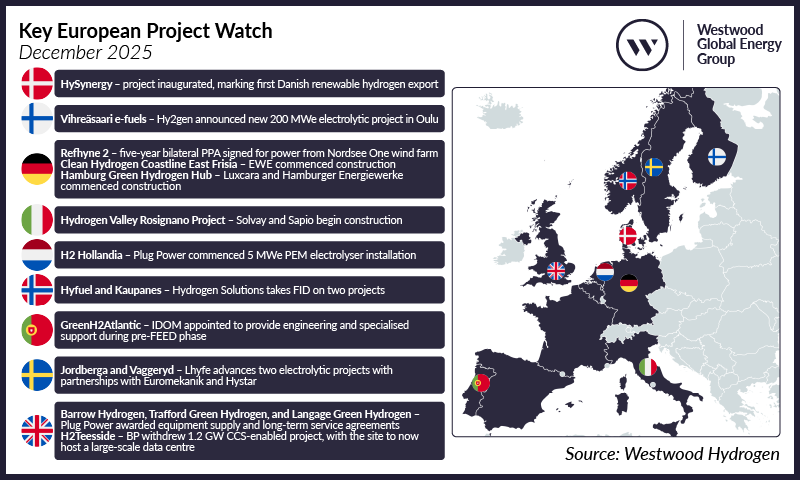

To date, a total of 9 winners have withdrawn from the first and second European Hydrogen Bank (EHB) auctions, resulting in 2.4 GWel of electrolysis capacity being dropped, and ca. 2 Mt of unmaterialised renewable hydrogen.

Among the factors leading to hydrogen project exits are regulatory uncertainties related to the transposition of the Renewable Energy Directive’s RFNBO provisions. Unrealistic deadlines and insufficient subsidies further aggravate the picture.

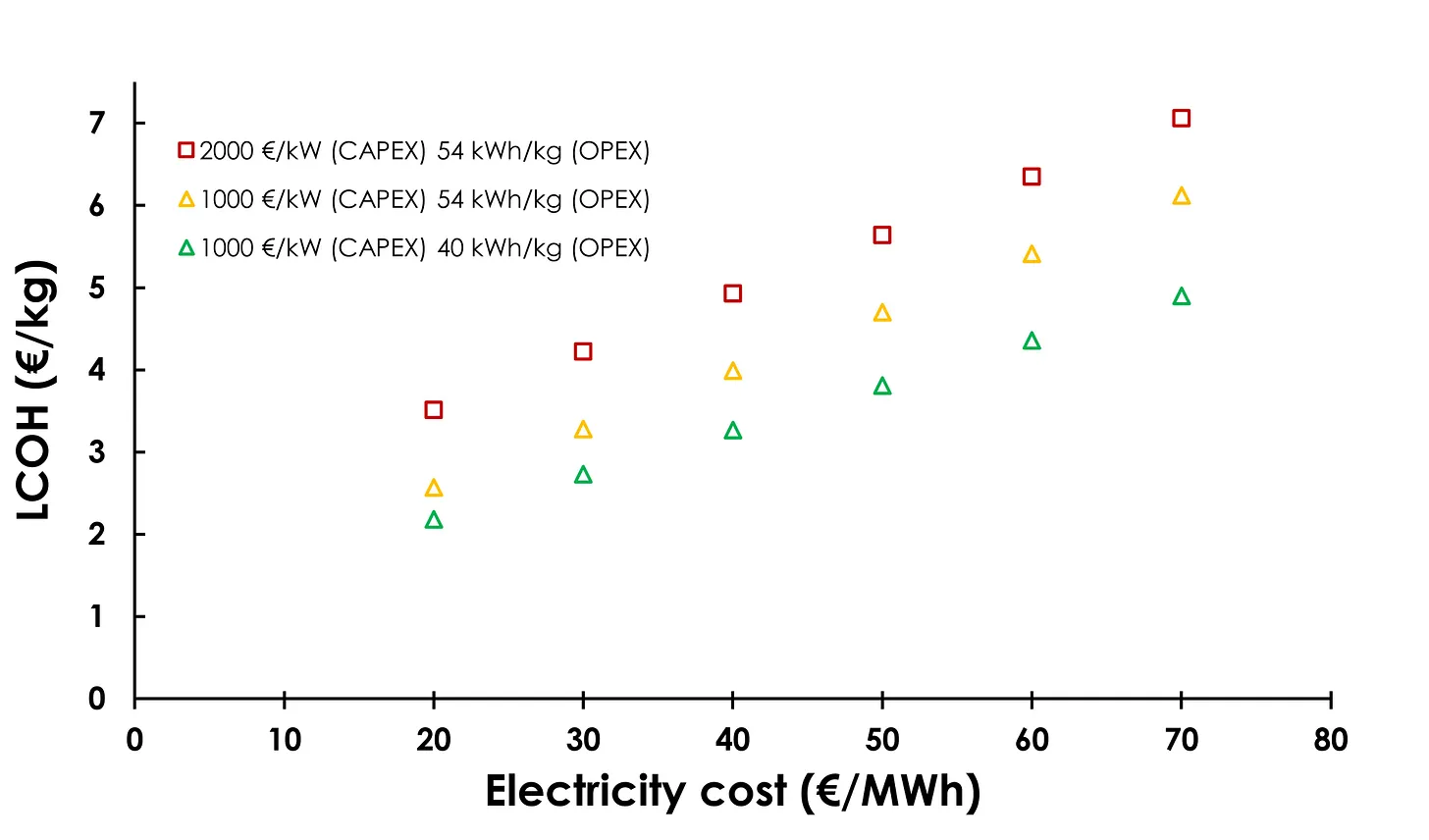

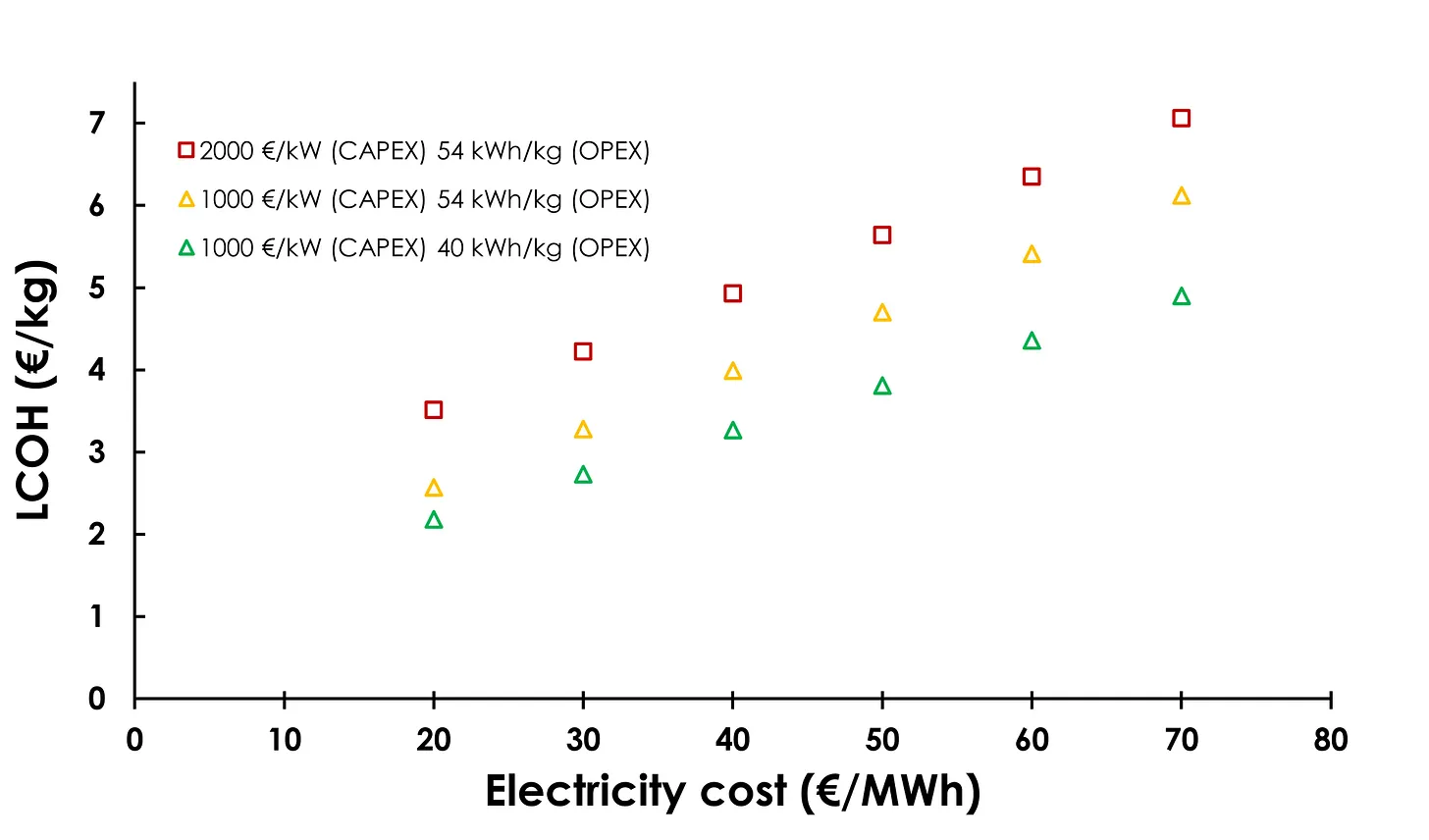

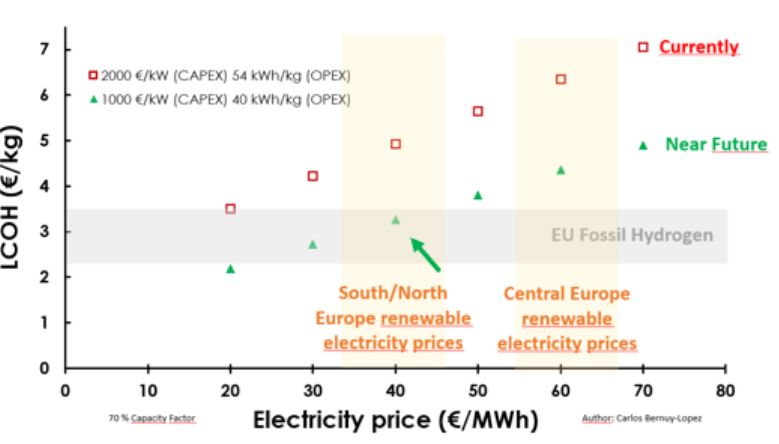

The ERCST – European Roundtable on Climate Change and Sustainable Transition’s report notes that “the winning bids are significantly below current market rates, raising concerns about the realism and bankability of the proposed business models, especially in the absence of long-term offtake agreements or reliable demand signals.”

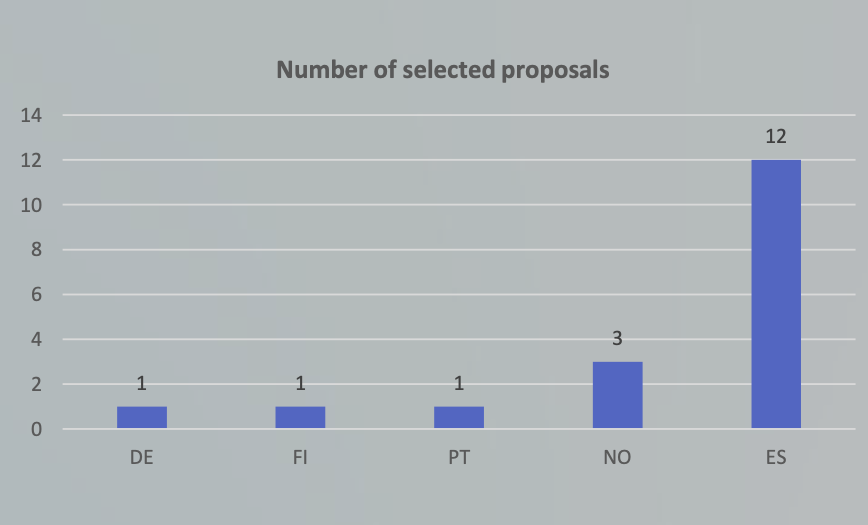

The remaining projects from the first round are now expected to produce around 0.9 Mt of renewable hydrogen over ten years in the EU, plus an additional 0.17 Mt in Norway; from the second round, 1 Mt in the EU and 0.15 Mt in Norway.

This comes in stark contrast to the Commission’s ambition (not a fixed target) of 10 Mt of annual domestic renewable hydrogen production by 2030.

The European Commission has invited ten additional projects from the reserve list to prepare grant agreements, with final award planned by the end of 2025.

Source: Mary Polovtseva