After a year of disillusionment, companies with sufficient demand for their products – be that electrolyzers, hydrogen or derivatives like ammonia, methanol or SAF – will do just fine. Less viable projects and companies will be weeded out by natural selection as much of the hydrogen world continues to grapple with existential challenges.

The positive stuff first: at least 12 auctions should take place in 2025, distributing as much as $28 billion to clean hydrogen producers. India and natural hydrogen will continue to generate excitement. The coming year may tell whether the two are special, or merely late to the party. US blue hydrogen producers could do quite well.

The less good stuff: with too many ‘gigafactories’ and low demand for their products, electrolyzer manufacturers are likely to struggle in 2025. It’s only a matter of time before some fold or get gobbled up. Other parts of the H2 industry could struggle, too.

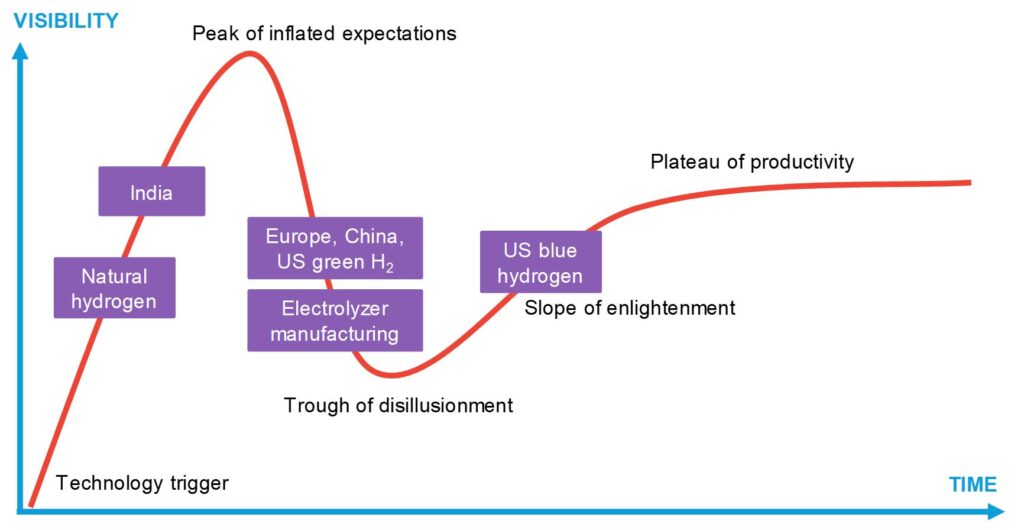

Explanation of diagram: BloombergNEF has borrowed Gartner’s Hype Cycle concept to illustrate the position of individual hydrogen market segments. India and natural H2 are yet to reach a peak of inflated expectations.

Europe, China, US green H2 developers and electrolyzer manufacturers are headed into a trough of disillusionment. US blue H2 may have moved on to a slope of enlightenment, assuming the incoming Trump administration keeps the 45Q tax credits intact. The list in the diagram is not exhaustive.

Source: Martin TENGLER, BNEF